ETH Price Prediction: Path to $5,000 Amid Mixed Signals

#ETH

- MACD bullish momentum at 85.37 supports upward price movement

- Institutional adoption and new financial products driving positive sentiment

- Key resistance at $4,500 must be broken for run toward $5,000

ETH Price Prediction

Technical Analysis: ETH Price Outlook

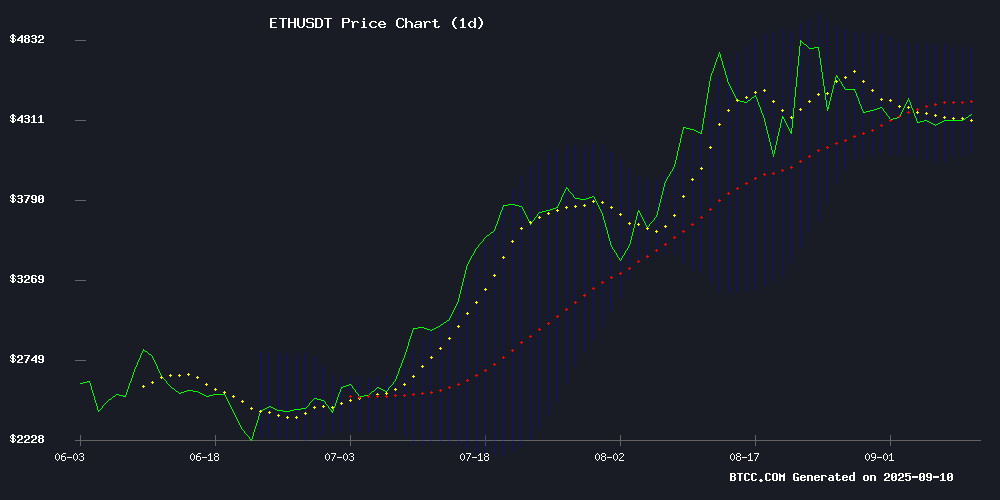

According to BTCC financial analyst Olivia, Ethereum's current price of $4,317.27 sits below its 20-day moving average of $4,436.03, suggesting potential near-term resistance. The MACD reading of 85.37 indicates bullish momentum remains intact, while Bollinger Bands show ETH trading within a range between $4,090 and $4,782. A break above the upper band could signal upward momentum toward $5,000.

Market Sentiment: Mixed Signals with Bullish Bias

BTCC financial analyst Olivia notes that while ethereum faces selling pressure and layer-2 network challenges, institutional adoption and innovative financial products like Ethereum-based stablecoins for mortgages are driving positive sentiment. The market appears range-bound between $4,200-$4,500, with breaking above $4,500 being crucial for a run toward $5,000.

Factors Influencing ETH's Price

Ethereum Validators Slashed in Rare Mass Penalty Event

Ethereum's proof-of-stake chain witnessed an unusual mass slashing event this week, with 39 validators collectively penalized. The incident marks one of the largest correlated validator penalties since The Merge.

Blockchain data reveals the affected validators were linked to SSV Network's distributed validator technology. While the protocol remained secure, infrastructure issues at third-party staking providers triggered the penalties. Ankr's maintenance procedures and a migrated Allnodes validator cluster caused the duplicate block proposals that led to slashing.

One validator with a 2,020 ETH stake suffered immediate losses of approximately $1,300. The event highlights the financial risks inherent in Ethereum's slashing mechanism, designed to punish validator misbehavior but rarely activated at this scale.

LitFinancial Launches Ethereum-Based Stablecoin for Mortgage Innovation

LitFinancial, a Michigan-based mortgage lender, has launched litUSD, a U.S. dollar-pegged stablecoin on the Ethereum blockchain. The move signals growing institutional adoption of digital assets beyond crypto-native applications. The ERC-20 token aims to reduce funding costs and enhance treasury management while exploring on-chain mortgage settlements.

Stablecoins are gaining traction as efficient payment instruments, with Keyrock projecting $1 trillion in payment volume by 2030. The regulatory landscape has matured significantly since the GENIUS Act became law in July, providing clarity for institutional adoption. "Stablecoins are rapidly becoming an essential tool for modern treasury operations," said CEO Tim Barry.

The mortgage industry's blockchain integration could transform liquidity in secondary markets through transparent loan performance tracking. LitUSD joins a growing cohort of compliant stablecoins bridging traditional finance with decentralized networks.

Finery Markets Integrates Yield.xyz to Bridge Institutional Investors and DeFi

Finery Markets has taken a significant step toward institutional DeFi adoption by integrating Yield.xyz, a yield aggregator platform. The partnership unlocks access to over 1,000 yield strategies across 75 blockchains, including Ethereum, Arbitrum, and Polygon.

Institutional clients can now deploy capital through Aave, Morpho, and Compound Finance directly from Finery's interface. The solution supports stablecoin staking, liquid staking, and restaking—consolidating treasury management for corporate crypto holdings.

"This solves market fragmentation," said CEO Konstantin Shulga. The move aligns with Finery's stablecoin-centric approach, offering institutions a unified gateway to decentralized yield generation.

Ethereum Holds Firm Above $4,300 as Institutional Adoption Fuels Bullish Sentiment

Ether maintains its bullish stance, trading at $4,367 with a 0.36% gain as technical indicators point to potential upside toward $5,000. The September correction appears to be a buying opportunity rather than a trend reversal, with the RSI hovering at a neutral 52.48.

Institutional adoption continues to anchor Ethereum's value proposition. Staking protocols now command $43.7 billion in TVL, while real-world asset tokenization has brought $24 billion onto the network. These fundamentals offset short-term volatility concerns.

Market structure remains resilient despite the 0.29% dip on September 3rd. The price holds comfortably above key moving averages, suggesting accumulation by long-term holders rather than speculative trading.

Ethereum Faces Mounting Selling Pressure Amid Broader Market Weakness

Ethereum struggles to maintain momentum as selling pressure intensifies, testing key support levels near $1,600. The world's second-largest cryptocurrency has failed to break through resistance at $1,700, raising concerns of a potential slide toward $1,500 if macroeconomic conditions worsen.

Market weakness reflects broader uncertainty across crypto and traditional assets, with rising interest rates and shrinking liquidity dampening investor sentiment. Analysts note Ethereum's underperformance relative to Bitcoin, suggesting its market leadership position may be weakening.

Technical indicators show deteriorating momentum, with the Relative Strength Index (RSI) signaling potential further downside. Some traders are shifting focus to presale tokens perceived to offer greater short-term upside compared to established assets like ETH.

Ethereum Faces Range-Bound Trading: Break Above $4,500 or Below $4,200?

Ethereum (ETH) has been trapped in a tight trading range for two weeks, with market participants awaiting a decisive breakout above $4,500 or breakdown below $4,200 to determine its next directional move. The cryptocurrency's consolidation reflects a battle between bullish momentum and profit-taking pressures.

Technical indicators tell a compelling story. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) both show strengthening momentum without entering overbought territory—a classic setup for potential upside. On-chain data reveals increased whale accumulation and consistent net inflows, signaling growing institutional interest in ETH.

The $4,200-$4,250 support zone has proven resilient, with buyers repeatedly defending this level. Meanwhile, immediate resistance clusters around the 20-day EMA at $4,345 and the 50-day EMA at $4,366. A clean break above these technical barriers could open the path to test the psychologically important $4,500 level.

SharpLink Gaming Initiates Share Buyback, Highlights Ether Holdings

SharpLink Gaming has commenced its $1.5 billion share repurchase program, buying back 939,000 shares at an average price of $15.98. The Minneapolis-based firm, one of the largest corporate holders of Ether, asserts its stock is undervalued relative to its cryptocurrency assets.

The company holds $3.6 billion in Ether, nearly all of it staked to generate yield. With zero debt and a volatile stock price—ranging from $2.26 to $124.12 over the past year—SharpLink emphasizes disciplined capital allocation. Management avoids equity issuance while shares trade below Net Asset Value, preserving shareholder exposure to Ether.

"The market underestimates our business," said co-CEO Joseph Chalom. Further buybacks are planned, contingent on market conditions.

Ethereum Layer-2 Networks Linea and Polygon Face Operational Setbacks

Two major Ethereum layer-2 solutions, Linea and Polygon, encountered operational disruptions on Sept. 10, raising fresh concerns about the reliability of scaling technologies. The incidents follow a recent four-hour outage on Starknet, another Ethereum layer-2 network, highlighting the persistent challenges in maintaining consistent uptime for rollup systems.

Linea, developed by Consensys, experienced a 46-minute pause in block production due to sequencer performance issues. The outage occurred just hours before the project's planned LINEA token airdrop, which has already attracted phishing attempts targeting community members. Meanwhile, Polygon faced finality delays, though details remain scarce. These disruptions underscore the growing pains of Ethereum's scaling ecosystem as demand for efficient transactions intensifies.

Ethereum's September Outlook After August Gains

Ethereum (ETH) posted modest gains in August, closing at a record high of $4,845 before settling at $4,286.94—a 1.72% monthly increase. Market capitalization now stands at $517.8 billion, with $32.06 billion in trading volume.

September presents a mixed technical picture. While the Moving Average suggests bullish momentum, the MACD indicator signals a bearish crossover. Analysts are divided, but CoinCodex projects a potential 21.76% ROI this month, targeting $4,781.08 with a trading range between $4,347.95 and $5,225.56.

Key resistance sits at $4,376.95, with support at $4,247.30. The altcoin's performance hinges on whether it can break through current technical barriers amid fluctuating market sentiment.

Ethereum Targets $4,800 by October 2025 Amid Mixed Market Signals

Ethereum's price trajectory remains a focal point for crypto investors as it consolidates near $4,300. Technical indicators suggest a potential breakout toward $4,800 by October 2025, despite conflicting analyst views. The current price of $4,302.22 reflects a market in digestion mode, balancing bullish foundations against neutral momentum.

Divergence dominates analyst projections, with PricePredictions.com forecasting an ambitious $13,765.63 long-term target while Bitget anticipates a modest 2.5% rise to $4,410.64 within days. Cryptopolitan's bearish $4,125 prediction underscores the market's uncertainty. Key levels to watch include immediate resistance at $4,424 and critical support at $4,044.

Ethereum Targets $6K Amid Diverging Fundamentals and Speculative Momentum

Ethereum's price trajectory defies cooling network revenue as speculative fervor pushes ETH toward $6,000. The second-largest cryptocurrency recorded a $4,900 all-time high in August despite revenue plunging to $14.13 million—its lowest since May. This disconnect reveals a market driven more by momentum than fundamentals.

Transaction fees held steady at $39.75 million, mirroring the four-month average, yet failed to translate into proportional network revenue. Meanwhile, trading volume skyrocketed to $1.13 trillion, underscoring traders' appetite for volatility over utility. Such conditions suggest Ethereum's rally leans heavily on liquidity flows rather than organic adoption.

Will ETH Price Hit 5000?

Based on current technical indicators and market sentiment, BTCC financial analyst Olivia believes ETH has a reasonable chance of reaching $5,000, though not without challenges. The MACD bullish momentum and institutional adoption provide support, but ETH must first break above key resistance at $4,500. A successful break could see ETH target $4,800 by October and potentially $5,000 thereafter.

| Target Price | Probability | Timeframe |

|---|---|---|

| $4,800 | High | October 2025 |

| $5,000 | Medium | Q4 2025 |

| $6,000 | Low | 2026 |